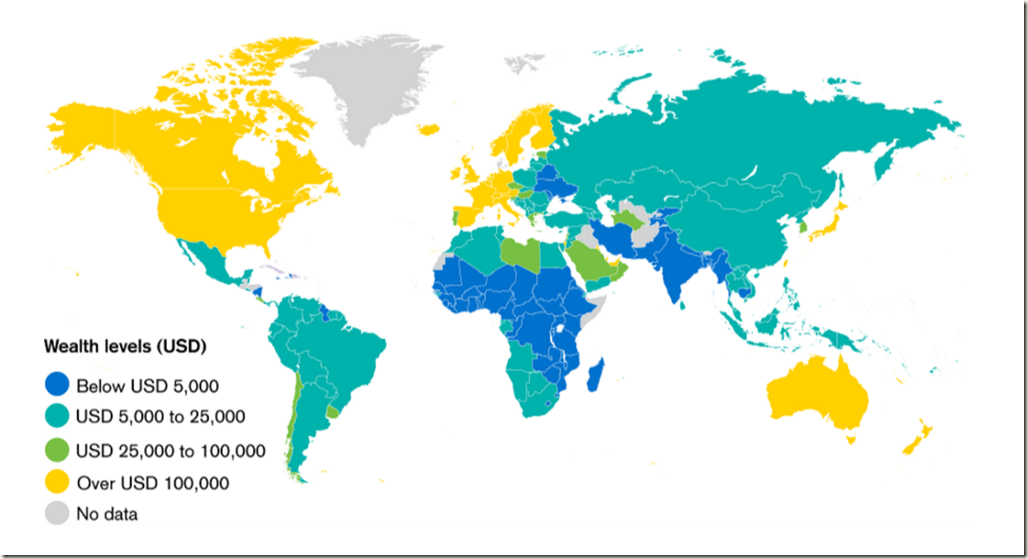

I watch the news go by like traffic on a motorway seen at a distance: speeding vehicles of uncertain purpose and unknown destination. In the news this morning, a charity calls upon the Prime Minister to take action on wealth inequality, saying that the United Kingdom is very “unequal”. Their data are drawn from the annual Credit Suisse 2015 wealth report, an indispensable guide for those who fear they are not keeping up with the Joneses. As you can see from the map above, Europe 1 and Europe 2 do well, as does Japan.

https://publications.credit-suisse.com/tasks/render/file/?fileID=F2425415-DCA7-80B8-EAD989AF9341D47E

The supposition behind this complaint is that wealth should be equal, and that it is proper and fair that wealth should be equally distributed among all persons. Any deviations from equal shares is seen as a cause for concern and immediate reallocation of personal savings. However, people are not equal in ability or diligence, so if they are allowed to work as their intelligence and character permit, some will rightly be earning more than others, in proportion to their efforts and skills. From that perspective, it is grossly unfair to resent the different contributions that different people make, and to demand they support the less diligent. Those who rise early should not be hated by those who rise late.

Three features of accumulated savings need to be understood.

First, a person who has been working and saving for 40 years will have more wealth than someone who has been working for only 40 minutes. Wealth is age related, and would be so even if everyone was paid the same wages, so long as people were free to save some of their income. Compound interest compounds over time, so a contribution made in the first year of work has a great impact on an eventual pension. The contribution made in the last year has no time to compound. If people are willing to save, their deferred expenditure gives them protective capital to ride out life’s storms. It is grain in the larder to protect against bad harvests. The young world will probably be a lot poorer than the old world, and bright countries will do well, so long as their governments are not idiotic. Demographics and governance matter.

Second, wealth can compound over two or more generations, if families have the wit and the love to support their children. Given freedom, families can show restraint in their own expenditures so as to help their descendants. Unless they are prohibited from doing so, most parents help their children. Inheritance taxes force them to help other people’s children.

Third, if a nation has a long history of saving, and is attractive to global investors, then nationals of that country will be repaid for generations of restraint by enjoying higher valuations on their property, bonds and savings generally. So, a long history of respecting property rights, following the rule of law, and always repaying national bonds without ever defaulting gives England a five or six century advantage. This amounts to at least 24 generations, probably more, since in Saxon times they paid danegeld to Danish invaders, showing that there was already wealth to be taxed. Nowadays savers in other less well organised countries will use England or the US to store their wealth, thus boosting all local asset prices. It may be temporary, but Londoners are reaping the delayed benefits of the establishment of Copyhold just after the Black Death.

For me, the real question is whether wealth is proportionate. Calculating proportionality is slightly more tricky than the simple notion that the fruits of a person’s labour belong to everyone. The bright will have their labour valued more highly, at the rate of 60% higher wages for those one standard deviation above the mean. Paying more for more flexible and productive workers is a great engine of wealth, and also of proportionate differences in income. Being willing to forgo immediate gratification for a benefit which comes 40 years later is an intelligence and personality test. Saving is a personal decision, set in a social and national context. Despite incentives, not all citizens save of their free will. Many have no savings at all, and could not last more than a month or two without having others pay their bills. Whatever their income, savers will be wealthier than non-savers. Those with rare talents will earn most.

Now to the world as a whole. Almost everyone is getting richer, healthier, better educated and living longer. This is good news. We are “unequal” with the past, even the recent past of 1970. We are far richer.

Now to proportionate matters. We will use the US dollar as the unit of account, even though that currency is never seen or handled by billions of people.

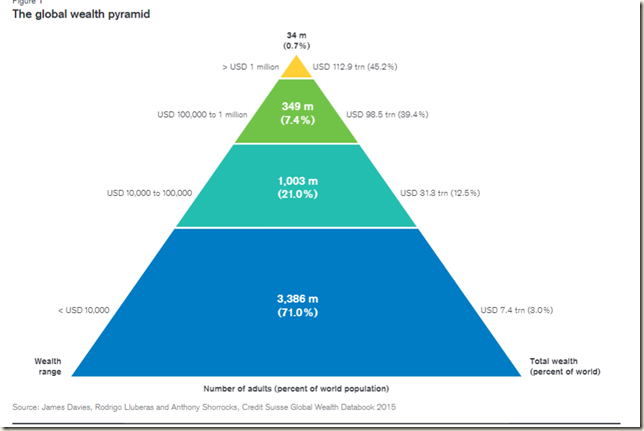

Once you get to savings of $3,210 you are in the top 50% of savers. With $68,800 you are in the top 10%, and with $759,900 you are in the top 1%.

Here, an interesting psychological point arises: do you compare yourself upwards or downwards? Older readers with a house and the prospect of a pension will be richer than young researchers starting their careers, so sticking to age cohort comparisons makes more sense. Do you compare yourself with the highest earners, or more properly with those who made the same career choices, probably research, university life, teaching and the like? Most readers of this blog will have been motivated by interests other than money.

As you probably know, I can simultaneously regret not having joined the Rolling Stones and not being a famous author, so I am no role model for sensible comparisons. From my point of view, the worst comparison of all is when another psychologist takes a minor finding and writes a book which leads to a lecture tour which leads to millions, and all for an effect I had classified as marginally interesting and of little significance. I feel that I should say something to those of you whose books have sold millions.

Briefly, selling best sellers is not enough. Try selling psychological tests, or a cunning program which boosts intelligence in 7 easy steps. Do not rest on your laurels.

I suppose that loathing comes from comparing upwards. What have they done to deserve it, say people staring at richer people above them? I can think of lots of things. They may have worked long hours in offices, doing work for others that did not interest them. They may have taken career risks, and worked even longer hours to build up a business. A few may have had the gift to sing, or write, or a talent to amuse. Good luck to all of them.

Just don’t remind me I should have written a best seller on how to lose weight while boosting your sex drive.

I was going to suggest that "those with rare talents will earn most" might be better as 'those with rare talents that are in demand will earn most'. It then occurred to me that perhaps we don't call a characteristic a talent unless it is demand.

ReplyDeleteI too considered your suggested addendum. Rare talents in poetry rarely lead to high incomes. Acclaim perhaps.

DeleteJust visited London recently. Indeed, nation of shop keepers. No wonder wealth of nation by Adam smith was from the land of shop keepers.

ReplyDeleteCertainly this helps to understand UK recent history and political stands.

The young world will probably be a lot poorer than the old world, and bright countries will do well, so long as their governments are not idiotic.

ReplyDeleteBy "idiotic", you mean criminally genocidal, more or less. Or "communistic", for yet one more way to say it.

Try selling psychological tests, or a cunning program which boosts intelligence in 7 easy steps.

Lol, I know not how many steps the USA educational No Child Left Behind — aimed at making children of all races "equal" in educational achievements — consists of. Would be funny if it were right 7.

What have they done to deserve it, say people staring at richer people above them? I can think of lots of things. They may have worked long hours in offices, doing work for others that did not interest them. They may have taken career risks, and worked even longer hours to build up a business. A few may have had the gift to sing, or write, or a talent to amuse. Good luck to all of them.

DeleteNo, not to all of them. I am not wishing luck to financiers, corporate executives, and other suchlike human disgraces.

So, no: technocrats, market fanatics, corporate execs, bankers (as we name usurers in our outwardly kindly age), the servant journalists and "academics" who work for them and propagandize the public, won't receive my good wishes.

But aside from their kind, yes, good luck to the rest of rich people, and congratulations: there's very good chances some or many other people benefit from their activity.

Since much real injustice exists, it is a pity that nothing is done to fight it (the criminally demagogic pushes for "equality" do nothing but deepen real injustice. And were any of these charity knights in good faith, they'd demand fairness, not "equality").